Urban Cover - Personal Accident Insurance Redefined

Premium starting from $11/month.

Urban cover seeks to provide the most holistic personal accident coverage across 3 core pillars that matters the most to you.

Policy WordingBeyond your usual accidental death and medical expense coverage. Urban Cover provides you support in your home mortgage, child tuition fee and utility bills.

Get free child coverage when purchasing for both you and your spouse * Note child's coverage will be 25% of adults sum insured* Please fill your child information to claim complimentary child coverage when you purchase insurance for your spouse as well. * Child coverage applicable for child 6mths old to 25 years old *Both self and spouse can only select similiar plan type.

WHAT URBAN COVER IS ALL ABOUT

Affordable Insurance Premium

Most value for money, 11 levels of protection with premium starting as low as $11 per month.

Accidental Medical Reimbursement

Up $6000 coverage for both in patient and out patient medical expenses caused by accident.

Monthly Home Mortgage Reimbursement

Up to $2,500 monthly for home mortgage payment in the event of an accident*.

Monthly Child Tuition Fee Reimbursement

Reimburse up to $1,000 for child tuition fee incurred in the event of an accident*.

Monthly Parent Allowance

Up to $1250 allowance payout to your parent over 6 months in the event of death caused by accident.

Monthly Utility Expense Support

Up to $150 per month for your utility bill while you are recuperating.

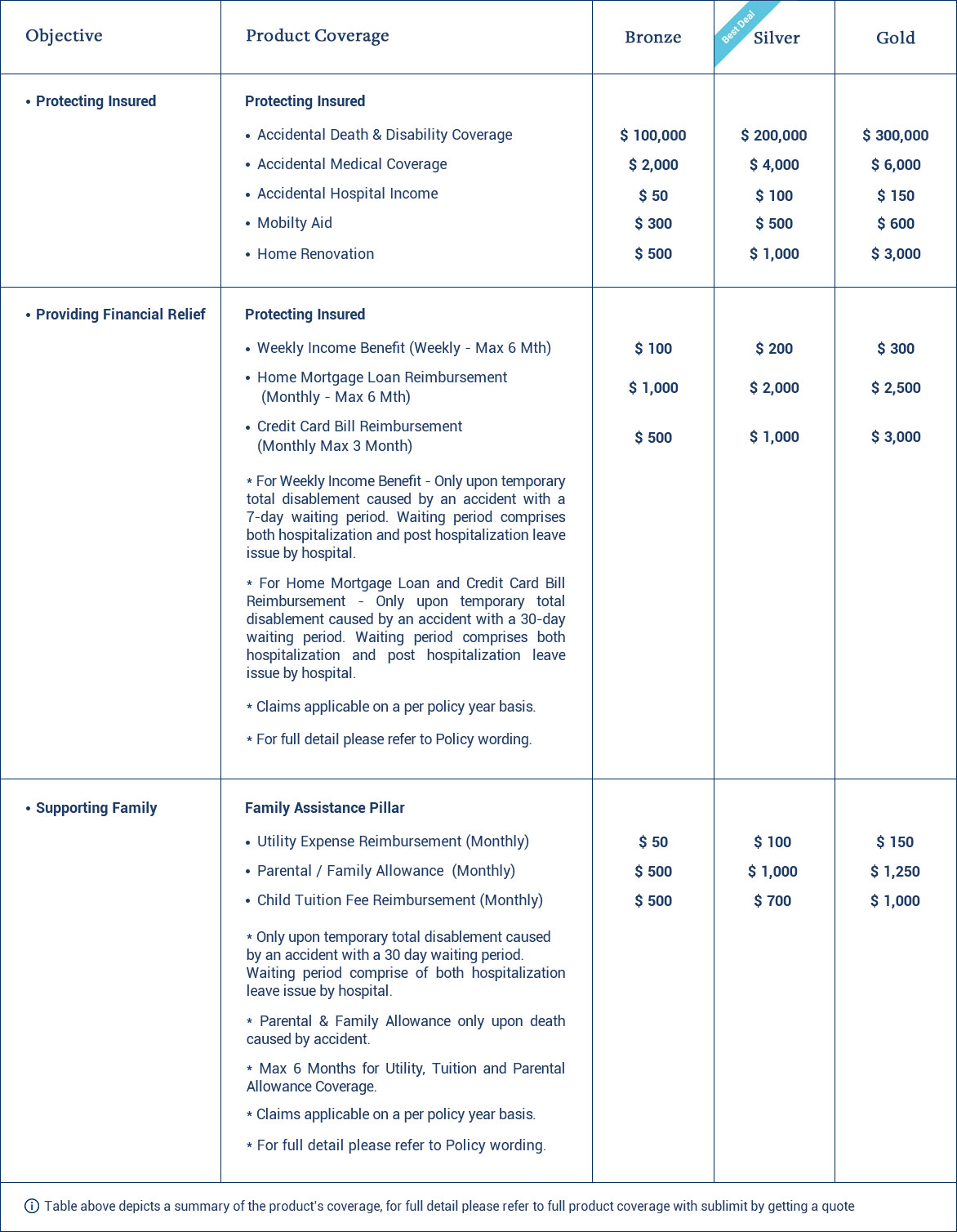

CHOOSE YOUR PLAN

OUR 3 PILLARS OF PROTECTION

Protecting the Insured:

The Personal Accident Pillar

With a premium starting from $11 a month, the first pillar of urban cover provides all the necessary personal accident specific coverages with Accidental death and disablement up to $300,000 and accidental medical expenses reimbursement of up to $6000.

Providing Financial Relief:

The Financial Assistance Pillar

Beyond hospitalization, Urban cover seek to provide financial assistance in the area of home mortgage reimbursement. Expect simple claims process with submission of latest 3 month mortgage statement.

Supporting Family:

The Family Assistance Pillar

While you are recupurating. Urban Cover provides child tuition fee reimbursement support of up to $1,000 per month. Similarly to claim submit invoice upon a 30 day waiting period.

WHO IS URBAN COVER FOR

Urban Cover is for Singapore’s working-class heroes, the sandwich generation who try to make ends meet for both their children and parents.

You are taking care of your parents and kids

You are shouldering multiple financial liabilities while working

You want to be financially protected in the event of an unforseen accident

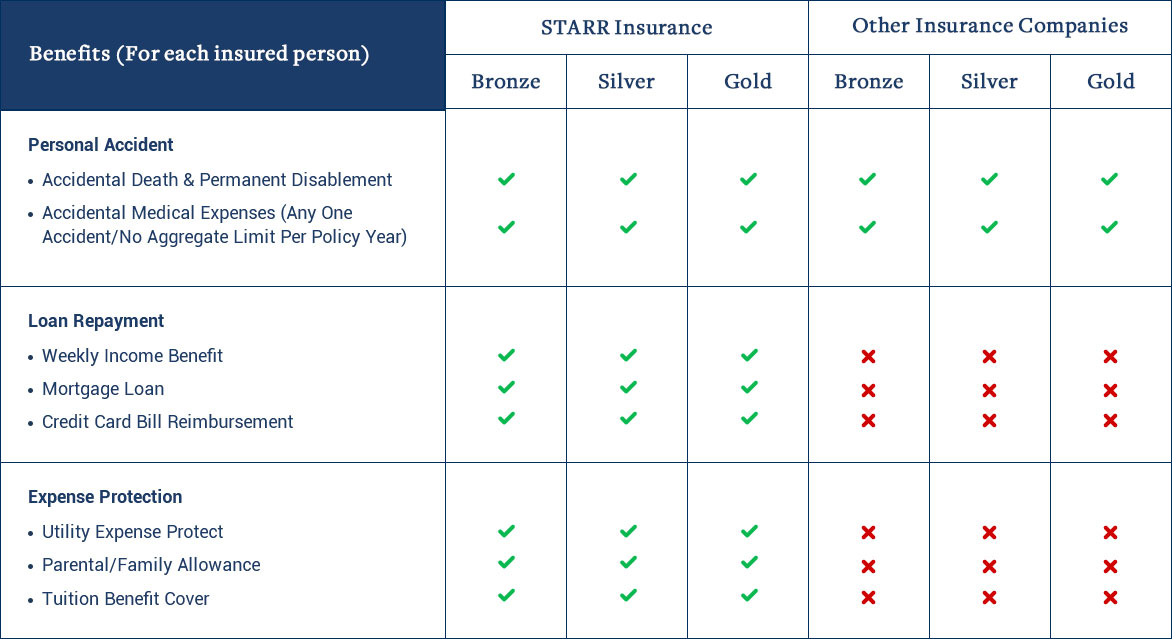

WHAT MAKES URBAN COVER DIFFERENT

With many products in the market, Choosing the ideal plan could be a hassle. What makes Urban Cover unique is how we go beyond what most insurance companies provide. Here is what you can expect from Urban Cover:

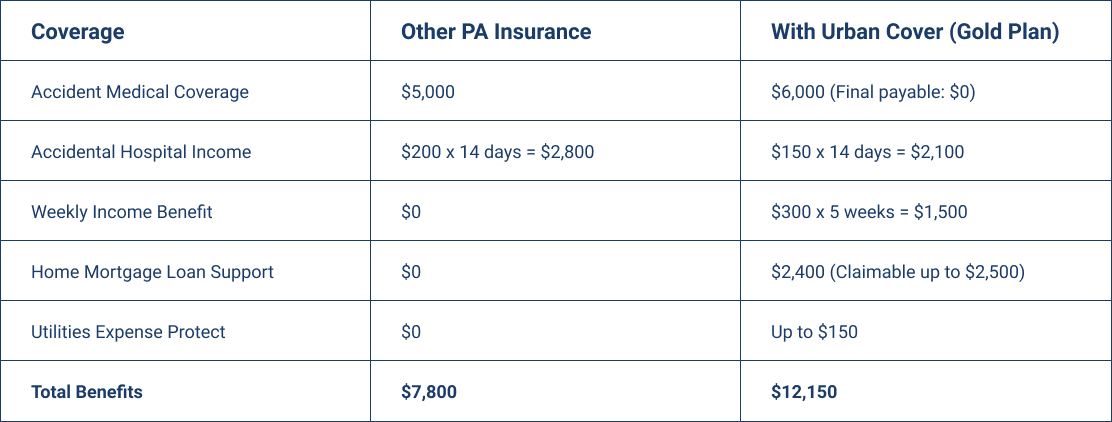

First Scenario:

A young sales professional with home mortgage loan obligation, experiences income loss after a severe car accident.

Lee is a 30-year old sales manager who depended largely on his sales commission to supplement his base salary. He received inpatient care at a hospital for 7 days and 28 days of hospitalisation leave after being discharged (fulfilling the 30 day waiting period). Due to the accident, he needs to be wheelchair bound throughout his recovery period.

This affected his earnings and inability to pay for his monthly condo home mortgage of $2,400.

Here is a quick breakdown of how Urban Cover Gold is able to help Lee tide over this difficult time.

Because Lee is protected with Urban Cover Gold, he is able to repay his home mortgage on time to avoid unnecessary interest charges and reduce the impact of the income loss due to the injury. He can now focus on his recovery, knowing that his financial obligations are all covered.

Second Scenario:

A sole breadwinner supporting his teen daughter through her tertiary education, experiences income loss after being knocked down by an irresponsible PMD food delivery rider.

Matt is a 39-year old sales development manager working in a trading firm, drawing a base salary that barely covers his daughter’s tertiary education fees and other household utility expenses. Depending heavily on this sales commission to make ends meet. He received inpatient care at a private hospital for 7 days and 35 days of hospitalisation leave after being discharged. Due to the accident, he needs to be wheelchair bound throughout his recovery period.

Here is a quick breakdown of how Urban Cover Gold is able to help Lee tide over this difficult time.

Because Matt is protected with Urban Cover Gold, he is able to continue supporting his daughter through her tertiary education. He can now focus on his recovery, knowing that his daughter will still be able continue her studies and household utility expenses are covered.